BT wins European Identity Award for Fraud Service powered by Oracle

Another year, another European Identity Award for an Oracle customer. At last weeks European Identity Conference, KuppingerCole gave their coveted award in the Governance, Risk Management and Compliance category to BT for their Managed Fraud Reduction service. The BT MFR service provides a real time risk assessment of online transactions, thus providing customers the ability to incorporate an extensible fraud detection tool into their environment at minimal cost.

The Solution

BT MFR brings together a comprehensive suite of fraud reduction capabilities under a single service. Device recognition, location recognition, behavior recognition and comprehensive policy enforcement through a customizable ruleset (powered by Oracle Adaptive Access Manager) provide granular risk assessments, returned in real-time so that even digital services requiring instantaneous delivery can be risk assessed for suspected fraud.

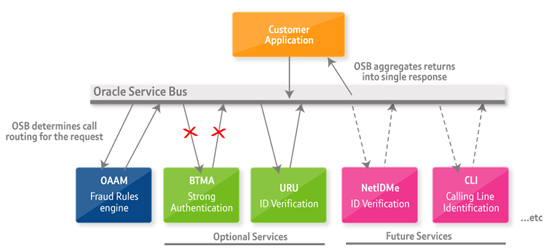

This functionality is all strung together and orchestrated by an Oracle Service Bus and accessed via web service calls. The routing and transformation layer that OSB provides allows for the augmentation of all the transaction data presented which can subsequently be used in a much richer risk assessment. The sources of such checks could be external URU or internal to the enterprise based on intelligence they’ve built up over years.

Risk assessments from multiple services can thus be aggregated to provide a single response to the protected application, containing all the information required to determine whether any transaction should continue forward.

Thanks to this unique design the service is also able to evolve, with new services integrated into the overall risk assessment procedure as they become required or available, without impacting the single web service call that the customer needs to access this battery of anti-fraud protection.

The Benefits

BTs Managed Fraud Reduction service has brought together a unique set of capabilities that address online fraud in ways that adapt to the organizations specific needs:

- Most online retailers cannot afford to issue password generating tokens to a fickle and ever-changing user-base. so a risk assessment based on transaction parameters such as device recognition and location provides a different way to achieve greater security.

- Online retailers providing digital goods or services cannot wait until shipping to review transactions (as delivery is immediate) so a system based on real-time assessment is greatly beneficial.

- Financial service providers need to assure funds transfers and payments within increasingly short windows (due to regulations such as ‘Faster Payments’) so real-time responses are essential.

- Gaming and leisure services are reliant on age-verification, so require identity verification score aggregated with the normal risk assessment. MFR allows the integration of such additional web services and will launch with BT’s URU identity verification available as an option.

- With the BT MFR service in place, customers can demonstrate to auditors that fraud prevention strategies are in operation and as a cloud service allows them to demonstrate this at a fraction of the cost compared to a self build strategy.

- With a robust fraud solution in place, customers can demonstrate to merchant acquiring banks that liability has been reduced.

- The architecture removes the need for the customer to contract separately with multiple vendors providing identity and fraud related services.

Addressing all market sectors and territories, fully customizable and simple to use, BT Managed Fraud Reduction service is an evolving one-stop solution to the ever-changing challenge of online fraud. And Oracle is proud to be a part of the solution. Online fraud can happen to anyone at any time and that’s why implementing steps to secure yourself online is critical, there is fraud prevention software that can be utilized for businesses and companies online to protect themselves and their customers.

Hi,

I think that BT always comes with the best solutions and this time they have done well and teamed up with ORACLE for this service to avoid any kinds of frauds that could affect their business model.

Hi,

I think that BT always comes with the best solutions and this time they have done well and teamed up with ORACLE for this service to avoid any kinds of frauds that could affect their business model.